You run a business or a professional practice. It is successful. You have a group of employees, along with yourself, who are key to business success. It is a great team. Margins are okay, but not great, and you or one of your key people becomes disabled and won’t return to work for a significant period of time – or ever.

Read MoreMKA Executive Planners Blog

Person Down & Out – What’s Next??? Rescued by Thinking Ahead

Posted by Barry Koslow on Tue, Oct, 30, 2018

Tags: Disability Income Protection, Key Person Insurance, Out of Work

Not-For-Profit Key People – The Unmeasured and Unprotected Risk

Posted by Barry Koslow on Mon, Oct, 22, 2018

When Richard E. Wiley passed away recently, he left a huge legacy at Endicott College. As its long time President, he grew the school from what was once a small regional two-year associates degree player to a nationally known multifaceted institution offering bachelors, masters and doctoral degrees. There are three campuses and a large range of options for study. It has an endowment in excess of $60 million, a 50% increase within the last five years.

Read MoreTags: Board Responsibility, Compensation, Not For Profit, Disability Income Protection, Key Person Insurance, Loss of Income, Out of Work

Don’t Let ‘em Get Away – Retention Programs That Keep Them on The Job

Posted by Barry Koslow on Tue, May, 29, 2018

It’s the worst! Your project has developed to the point where you’re about to build the working model and file the application for a patent or FDA approval. The scientist who is heading the project walks into your office and tells you she or he is leaving for another position at the company a half mile down the road. He or she has led a small team and doesn’t have a back-up.

Read MoreTags: Compensation, Executive Compensation, Supplemental Compensation Plans, Key Employee Retention

Everyone relaxed when the House and Senate decided not to block deferred compensation plans as we know and love them.

Read MoreTags: 457(b) Plans

Your career has brought you to the top because of the great experience of working for several major companies, both in and out of your current company’s industry. You’re in the C-Suite and playing an important role in management and moving your company forward. You have a great salary and a wonderful work environment.

Read MoreA Good Problem to Have…Savings Alternatives for Senior Executives and Professionals

Posted by Dennis Sexton on Tue, Dec, 12, 2017

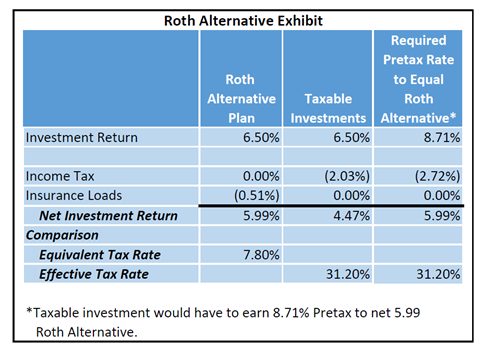

Senior executives and professionals in both the not-for-profit and taxable sectors have a problem that most people would envy. Where do they put savings above qualified retirement plan limits? They can’t qualify for a traditional or Roth IRA as an individual taxpayer. Employer sponsored deferral and savings vehicles are subject to regulations that make them restrictive, inflexible, public and insecure, e.g. the executive’s savings may be exposed to creditors of his or her employer. Plus, they can’t access the money easily should they need it.

Read MoreTags: Retirement Planning, Executive Compensation, After Tax Plans

According to news reports, New York Giants star receiver Odell Beckham, Jr., is thinking about purchasing a $100 million (yup, $100,000,000) policy to protect the value of his earning potential in the event he is injured and cannot earn pay at his current ability level. The importance of this was brought home when he sprained an ankle at a recent pre-season game.

Read MoreTags: Disability Insurance, Executive Disability, Disability Income Protection

MKA offers concierge underwriting for its high net worth investors, business owners and highly-compensated professional and executive clients. Concierge underwriting is hands on and handled on a secure and personalized basis by us and our associates. Here is a recent example.

Read MoreTags: Life Insurance, Universal Life, Concierge Underwriting

“What?”, you say. Yes, there are many significant risks out there, and you buy commercial insurance to absorb them. Autos, homes and other property are insured. You have liability insurance. You have medical insurance. You have dental insurance – and maybe life insurance. But, actually, you hold all those risks. You have chosen to “reinsure” them in full or in part with a business that specializes in covering unaffordable risk. You get to pick the maximum amounts payable and deductibles, absorbing the affordable exposures that you did not cover.

Read MoreTags: Disability Insurance, Executive Disability, Disability Income Protection

In Business, Everyone Is NOT Replaceable… at least not right away

Posted by Ed Perry on Thu, Jul, 13, 2017

Tags: Life Insurance, Disability Insurance, Executive Disability, Long Term Disability, Key Person Insurance