It’s the worst! Your project has developed to the point where you’re about to build the working model and file the application for a patent or FDA approval. The scientist who is heading the project walks into your office and tells you she or he is leaving for another position at the company a half mile down the road. He or she has led a small team and doesn’t have a back-up.

Read MoreMKA Executive Planners Blog

Don’t Let ‘em Get Away – Retention Programs That Keep Them on The Job

Posted by Barry Koslow on Tue, May, 29, 2018

Tags: Compensation, Executive Compensation, Supplemental Compensation Plans, Key Employee Retention

A Good Problem to Have…Savings Alternatives for Senior Executives and Professionals

Posted by Dennis Sexton on Tue, Dec, 12, 2017

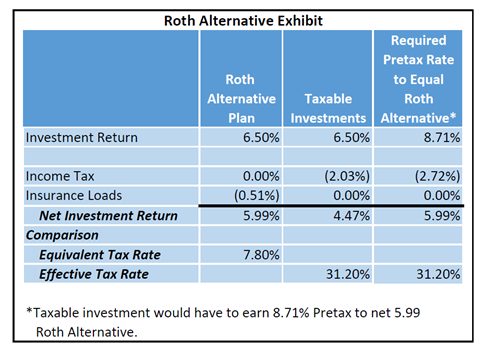

Senior executives and professionals in both the not-for-profit and taxable sectors have a problem that most people would envy. Where do they put savings above qualified retirement plan limits? They can’t qualify for a traditional or Roth IRA as an individual taxpayer. Employer sponsored deferral and savings vehicles are subject to regulations that make them restrictive, inflexible, public and insecure, e.g. the executive’s savings may be exposed to creditors of his or her employer. Plus, they can’t access the money easily should they need it.

Read MoreTags: Retirement Planning, Executive Compensation, After Tax Plans

After Tax Plans: An Alternative to Deferred Compensation Plans

Posted by Barry Koslow on Fri, Mar, 24, 2017

After tax supplemental compensation plans funded with life insurance offer a hybrid arrangement that reduces the complexity and expense associated with non-qualified deferred compensation plan. These plans are a great benefit for a company to offer to non-owner key executives to retain and reward them for their valuable services. They are especially attractive in pass through entities such as Subchapter S corporations and tax exempt organizations.

Read MoreTags: Life Insurance, Deferred Compensation Plans, Executive Compensation, Supplemental Compensation Plans, After Tax Plans

Section 457(b) and 457(f) plans are the most common supplemental retirement accumulation plans utilized by tax exempt organizations. While many provisions apply to both models, the rules applicable to 457(f) plans are particularly onerous. Here are 8 ugly facts about Section 457(f) plans.

Read MoreTags: Supplemental Retirement Plan, Retirement Planning, Executive Compensation, Physician Supplemental Plans, 457(f) Plans, Not for Profit Supplemental Plans

Bonus Clawbacks at Not-For-Profits: Are They Inevitable?

Posted by Barry Koslow on Tue, Jul, 14, 2015

Many publicly traded companies have provisions in their compensation policies and employment contracts that require bonuses be paid back and recovered by the employer under certain circumstances.

Read MoreThe Empress’ Disability Policy – Now You See It ---Oops!

Posted by Barry Koslow on Tue, May, 20, 2014

This is a story about disappearing disability income benefits. One of the worst tragedies that can befall an executive, professional or business owner is an extended period of disability as a result of accident or illness.

Tags: Disability Insurance, Compensation, Executive Compensation

CommonWealth Column: College Presidents Need to Be Paid Well

Posted by Barry Koslow on Tue, Apr, 08, 2014

CommonWealth magazine recently posted an opinion piece by Barry Koslow that focuses on executive compensation for leaders of private colleges and universities. The article begins:

Tags: Deferred Compensation Plans, Board Responsibility, Executive Compensation

Catastrophe -- Key Player Hit by Total & Permanent Disability

Posted by Barry Koslow on Mon, Mar, 24, 2014

You're on your way. Your company recently completed a round of serious financing from a major hedge fund and several significant individual investors. Management has been beefed up so that the "idea gal" can focus on what she does best -- building the greatest and newest health gizmo, one that will improve outcomes and reduce costs.

Tags: Disability Insurance, Board Responsibility, Executive Compensation

The media and the public (not sure which drove which) have become frenzied over executive compensation, making broad-brush examples out of a few outliers. It is time to settle down and realize the importance of a proper balance between what is actually “bad” and what is not. Legislation and regulation are not the answer. We need careful analysis, decision making and the willingness to act on behalf of both employees and the organization.

Tags: Supplemental Retirement Plan, Deferred Compensation Plans, Board Responsibility, Executive Compensation

It is becoming more and more obvious that we all need to pay more attention to our long term need for capital accumulation. Concerns are growing that the current dysfunction of our federal government and the continuing growth of entitlement programs may force more and more of the middle and upper classes to become self-reliant. It is not a question of approval of the current direction of government. It is whether the resources will be there to meet the promises made, while providing for other needs such as defense, infrastructure, etc.

Tags: Supplemental Retirement Plan, Retirement Planning, Deferred Compensation Plans, Executive Compensation

-Plans.jpg)